Has the slowdown in Lululemon's fitness apparel market peaked?

2025-06-27

2025-06-27

Sansansun

Sansansun

Lululemon has long dominated in the athleisure space with its premium fitness apparel and loyal customer base. However, recent research reveals that the brand's growth in the US market is slowing.

The rise of new fitness apparel manufacturers such as Alo Yoga, which appeal to consumers with a more lifestyle-oriented approach, and the proliferation of cheaper alternatives have led to a slowdown in growth across the market. Although Lululemon remains a leader in the market, increased competition highlights that the market is constantly evolving and brand loyalty is facing unprecedented challenges.

Lululemon's strong position in the US athleisure space is facing increasing pressure

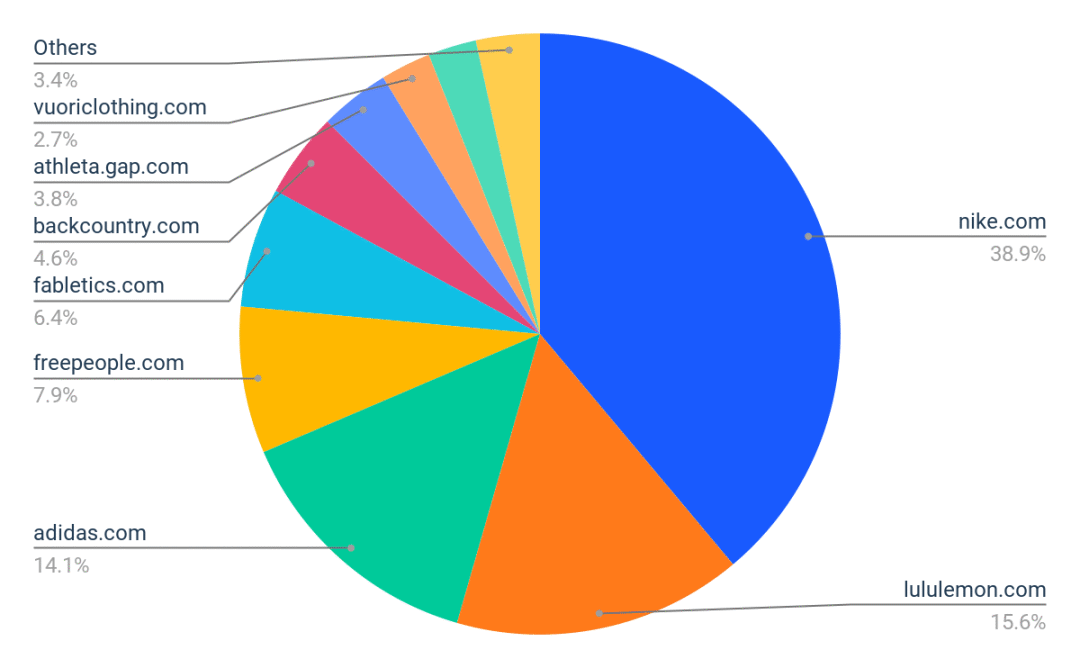

As of the end of August 2024, Lululemon accounted for 15.6% of the market share in the US DTC athleisure market by visits, ahead of Adidas and second only to Nike, which accounted for a considerable 38.9% of the market.

However, while Lululemon's market share was dominant earlier this year, it has since declined, falling to 14.5% in the past three months, behind Adidas' 16%. The loss of market share comes from established competitors like Adidas and smaller but fast-growing competitors like Alo Yoga, Vuori, and British brand Gymshark.

While Lululemon still has a large following in the U.S., these shifts suggest that brand loyalty may be wavering as consumers move from more casual-focused brands like Vuori to more affordable brands like Gymshark.

Economic growth appears to be slowing

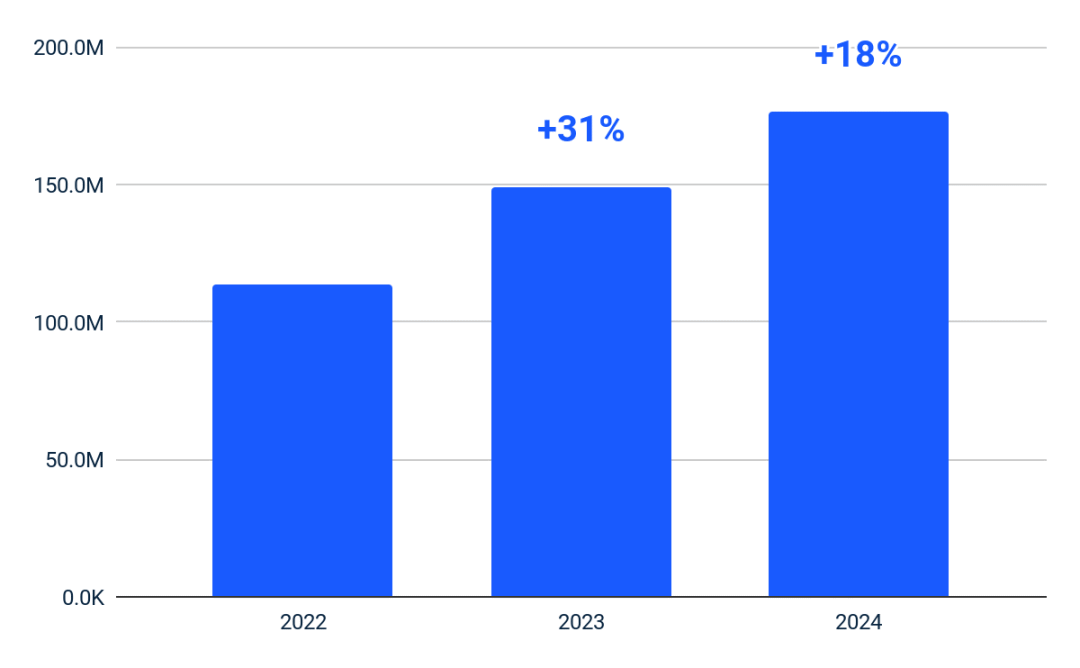

Data shows that the growth rate of Lululemon's U.S. website visits has slowed from 31% in 2023 to 18% in 2024. They may have encountered several key problems:

This slowdown suggests that Lululemon may be facing several problems:

As mentioned above, the athleisure space is becoming increasingly competitive with the rise of competitors such as Vuori, Alo Yoga, and Gymshark. These brands are gaining traction, offering premium alternatives that cater to different segments and taking traffic away from Lululemon.

After years of rapid growth, Lululemon's core market may have reached saturation. Many consumers who fit the brand's premium positioning already own Lululemon products, and since Lululemon prides itself on the quality of its products, consumers may not need to switch products, resulting in fewer repeat visits and purchases.

As trends evolve, so do consumer interests. As a result, shoppers are increasingly seeking out new brands with niche benefits, such as Alo Yoga's holistic lifestyle. This diversification appears to be drawing potential customers away from Lululemon's website.

Despite Lululemon's many fans, some consumers may be experiencing "brand fatigue" because the Lululemon aesthetic has become ubiquitous and no longer feels unique. With the rise of newer, fresher brands, consumers may be more inclined to explore other options, affecting website traffic.

Why does this happen?

Marketing strategy may be inefficient

While Lululemon drives a lot of traffic through paid search on desktop and mobile platforms, its marketing strategy seems to have room for improvement. One area of concern is its relatively high cost per visit. Among its closest competitors, Lululemon has the highest cost per visit, second only to Alo Yoga, suggesting that they are spending more than their competitors to attract traffic. In contrast, Gymshark’s cost per visit was over a dollar lower, but it still achieved strong engagement, suggesting a more efficient allocation of its marketing spend.

This discrepancy highlights potential inefficiencies in Lululemon’s paid search efforts. While their brand awareness enables them to drive a lot of traffic, the high costs suggest that they may not be targeting their audience as effectively as their competitors, or that they could improve relevance and reduce bidding costs by improving their keyword strategy.

Additionally, diversifying data access by focusing more on organic search, social media, or influencer partnerships could reduce reliance on paid search, reduce overall marketing costs, and allow them to invest in other areas, improve ROI, and fight back against competitors.

Economic pressures lead to price sensitivity

Alo Yoga and Gymshark aren't the only competitors challenging Lululemon’s market share; the rise of cheaper alternatives on platforms like Amazon is also fueling competition. Inflation and economic uncertainty could also curb growth.

Lululemon’s high prices could put off budget-conscious consumers who now prefer more affordable options.

Amazon’s yoga category saw significant growth in the US from January to August 2024, with both unit sales and revenue increasing by more than 25%. The yoga leggings category was the primary driver of this growth, with both units and revenue increasing by an impressive 30%.

Of particular note are the prices of these leading brands. Drilling down into the top 10 brands in Amazon’s yoga leggings category, we find that their average selling price is $30 or less, significantly cheaper than Lululemon leggings, which sell for around $100.

This price differential is tempting budget-conscious consumers away from premium options like Lululemon, especially as the quality of affordable alternatives continues to improve. These Amazon brands are capitalizing on the platform’s convenience, aggressive pricing, and wide reach to capture the growing demand for affordable activewear.

In addition, many brands benefit from Amazon’s fast shipping, easy returns, and user reviews, which make it easier for shoppers to trust low-priced goods. This is an attractive value proposition for consumers who value functionality over brand loyalty or fashion trends. Lululemon faces the challenge of defending its market position against these low-cost competitors that are rapidly rising on the strength of convenience and price.

Given this trend, Lululemon needs to adjust its strategy to compete not only with high-end DTC brands but also with increasingly popular affordable alternatives on mainstream e-commerce platforms such as Amazon, AliExpress, and Temu. Whether by enhancing the premium value of its products or exploring new pricing and distribution strategies, Lululemon must respond to this growing threat from below.

It Can't Meet the Needs of Today's Consumers

Alo Yoga’s conversion visits increased 47%, far exceeding Lululemon’s modest 3% growth over the same period. This huge difference highlights that Alo is not only successfully attracting web traffic, but also converting that traffic into actual sales at a higher rate, indicating that they are meeting consumer needs in a way that Lululemon may not have.

Several factors contributed to the surge in conversions:

Alo effectively uses influencer marketing, athlete sponsorships, and social media partnerships to drive a large amount of traffic to its website. These targeted marketing campaigns often invite influencers to showcase Alo products intimately and engagingly, which creates a direct connection from inspiration to purchase and drives conversion growth.

Alo focuses on trend-setting, fashion-forward sportswear, but also has a street style, attracting fashion-conscious consumers who are more likely to buy immediately. This versatility makes the brand very attractive to consumers who are looking for both sports and daily wear.

Alo's positioning as a health and lifestyle brand rather than a pure sportswear company has cultivated a loyal customer base that resonates with its broader content, such as yoga, mindfulness, and wellness. This alignment with customer values and lifestyles enhances their ability to convert visits into sales.

This is evident from the keyword traffic, where Alo beats Lululemon: terms covering fitness wear, yoga gear, or very specific product searches indicate that consumers know the exact items they are looking for and visit Alo to purchase those products.

When looking for a fitness wear supplier with similar quality to Alo, Sansansun is an option worth considering as a professional fitness wear manufacturer. Located in Dongguan, Guangdong Province, China, Sansansun is a professional fitness wear factory that focuses on designing, producing, and wholesaling first-class yoga wear for international brands and customers. They combine exquisite craftsmanship with innovation to create high-quality yoga wear that is comfortable, fashionable, and practical. Sansansun's pursuit of excellence is reflected in every meticulous sewing process, ensuring that its products exceed the highest industry standards.

Inquire(

Inquire(

HOME

HOME Top 10 Sportswear Manufacturers in China

Top 10 Sportswear Manufacturers in China  You May Also Like

You May Also Like

Tel

Tel

WhatsApp

WhatsApp

Email

Email

Address

Address